Cashflow Modelling

A clear view of your financial situation

Understanding your finances isn’t just about what you have today - it’s about knowing where you're heading. At Two10 Investment Services, we use cashflow modelling to give you a clearer picture of how your financial future could unfold.

This powerful tool helps you see how decisions made today - from spending and saving to investing and retiring - may impact your lifestyle over time. By turning complex questions into clear projections, we help you understand what’s possible and build a plan that supports the life you want to lead.

Helping you make financial decisions with confidence

Making big financial decisions can often feel daunting - but having a clear picture of your future can make all the difference. At Two10 Investment Services, we use detailed cashflow modelling to bring together every aspect of your finances, from income and outgoings to investments, pensions and long-term goals.

It’s designed to help you answer life’s important questions such as:

- Can I afford to retire early?

- How much can I spend without risking my future?

- Will I have enough to support my Retirement or provide for my family?

More than just a projection, cashflow modelling supports real-time decisions - whether it’s the right time to retire, how to structure your investments, whether to sell a property or gift money, or how to make tax-efficient withdrawals.

With this insight, you can move forward with clarity, purpose and confidence - knowing your financial decisions are built on firm foundations.

What cashflow modelling looks like

Cashflow modelling turns complex financial planning into a clear, visual experience. At Two10 Investment Services, we use easy-to-understand forecasts to show how your finances may evolve over time - helping you see the bigger picture with confidence.

We can compare different scenarios side by side, such as retiring at 60 versus 65, or downsizing your home versus keeping it - so you can understand the potential outcomes before making big decisions. The model accounts for real-world factors like inflation, market fluctuations and significant life events, giving you a realistic view of your financial future.

It provides reassurance that your plan is on track - or highlights when adjustments are needed. And because life doesn’t stand still, we update your plan regularly to reflect changes in your circumstances, goals or the wider economy - keeping you in control, every step of the way.

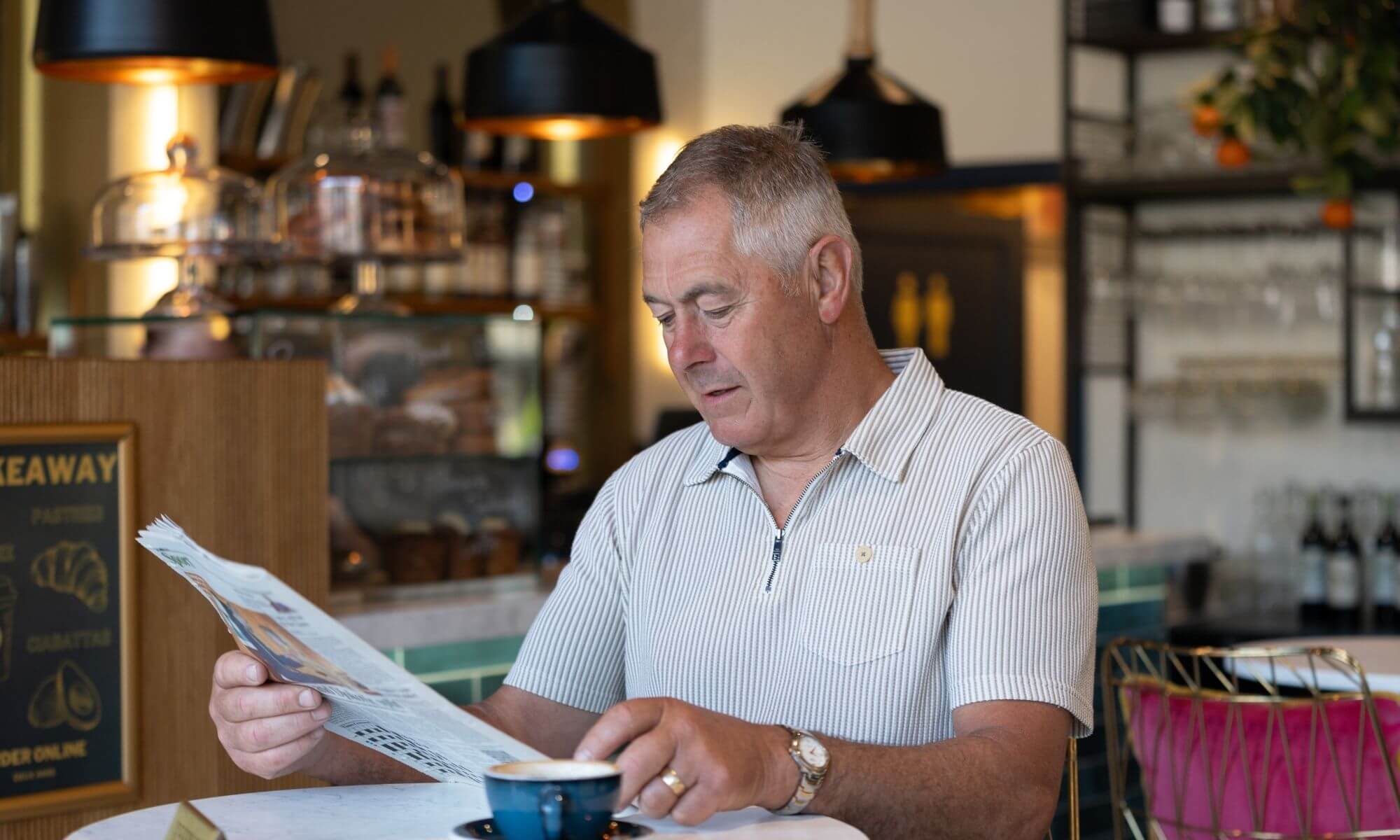

Our local team by your side

At Two10 Investment Services, financial planning is personal. You’ll work one-to-one with a dedicated adviser who takes the time to understand your goals and priorities - and explains your financial projections in a clear, meaningful way.

Our advice is built around your real life, not just the numbers on a spreadsheet, with ongoing support to help you stay on track as things evolve. Based on Berry Lane in Longridge our team is always accessible, providing the reassurance of national-level expertise with the familiarity of a trusted, face-to-face relationship.

.jpg)

Financial Planning FAQs

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat.

Cashflow modelling is a way of mapping out your financial future. It brings together your income, spending, assets and goals into one clear picture - helping you see if you're on track and what steps you might need to take to stay there.

Cashflow forecasts are based on realistic assumptions about inflation, investment returns and your lifestyle. While they can’t predict the future exactly, they provide a strong foundation for informed planning and decision-making.

Yes. One of the biggest benefits of cashflow modelling is the ability to explore “what if” scenarios - such as retiring earlier, selling a business, or supporting children financially. It helps you understand the impact of different choices before making them.

No - cashflow modelling is useful for anyone who wants to make better financial decisions. Whether you’re building wealth, planning for retirement or managing a business exit, it gives valuable clarity and confidence at every stage.

We recommend reviewing your cashflow model at least annually - or whenever your circumstances change significantly. Regular reviews help keep your plan relevant and ensure it continues to reflect your goals.

Life changes - and your financial plan should change with it. Cashflow modelling is designed to be flexible, allowing updates whenever needed so it always reflects your current situation and priorities.

Cashflow modelling supports financial advice - it doesn’t replace it. It gives a visual framework for making decisions and works best when paired with tailored guidance from a financial planner who understands your full picture.

Still have questions?

Our team are on hand to help you, conversations cost nothing and initial consultations are complimentary. Get in touch with us today.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)